BTC Price Prediction: Analyzing the Path to $200K Amid Institutional Frenzy and Technical Breakouts

#BTC

- Institutional Accumulation - Massive purchases by Strategy and Capital Group totaling over $79 billion in Bitcoin holdings demonstrate unprecedented institutional confidence

- Technical Breakout Potential - Current price action near Bollinger upper band with strong support at 20-day MA suggests imminent upward movement

- Regulatory Clarity - Gemini-SEC settlement and positive regulatory developments reduce uncertainty and encourage broader adoption

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

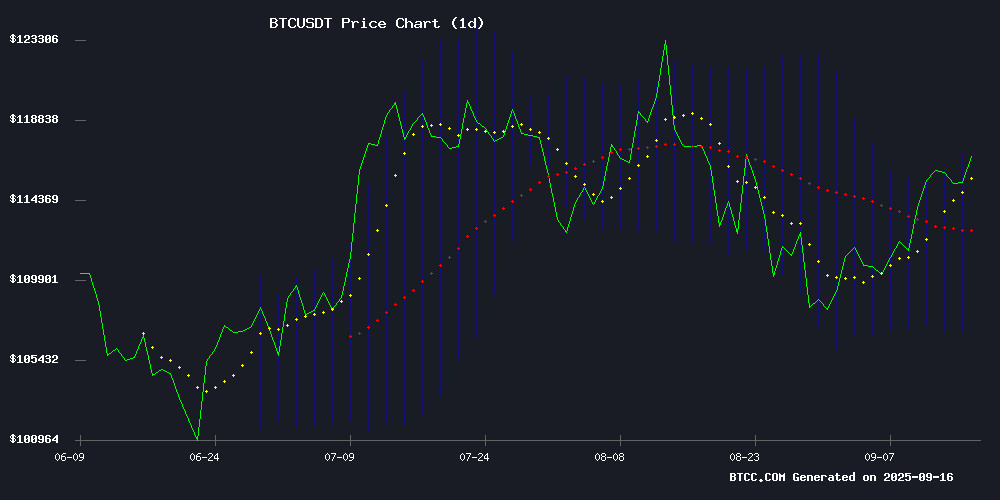

BTC is currently trading at $115,314.47, comfortably above its 20-day moving average of $112,192.03, indicating sustained bullish momentum. The MACD reading of -2327.51 | -376.19 | -1951.32 suggests some near-term consolidation but maintains overall strength. Bollinger Bands show price action NEAR the upper band at $117,355.72, signaling potential resistance levels while the middle band at $112,192.03 provides solid support.

According to BTCC financial analyst Michael, 'The technical setup suggests BTC is building a foundation for another leg higher, with the $112K level acting as crucial support. A break above $117,355 could trigger the next upward movement.'

Market Sentiment: Institutional Accumulation and Regulatory Progress Drive Optimism

Current market sentiment remains overwhelmingly positive as major institutions continue accumulating Bitcoin. Strategy's massive $73 billion Bitcoin holdings and Capital Group's $6 billion bet demonstrate strong institutional confidence. The Gemini-SEC settlement removes regulatory uncertainty while Tom Lee's $200K forecast for 2025 aligns with growing institutional adoption.

BTCC financial analyst Michael notes, 'The combination of regulatory clarity and unprecedented institutional investment creates a perfect storm for Bitcoin's next major rally. The $115K level holding steady amid these developments is particularly encouraging.'

Factors Influencing BTC's Price

Gemini and SEC Reach Tentative Settlement in Earn Program Lawsuit

Gemini has reached a tentative settlement with the U.S. Securities and Exchange Commission, potentially resolving a high-profile lawsuit over its Earn lending program. The agreement, disclosed in a Sept. 16 court filing, follows Genesis Global Capital's bankruptcy, which left $900 million in customer assets frozen.

The Earn program allowed users to lend cryptocurrencies like Bitcoin (BTC) to Genesis in exchange for interest, with Gemini collecting fees up to 4.29%. The collapse of FTX in November 2022 triggered Genesis's withdrawal freeze, culminating in its January 2023 bankruptcy filing. The SEC sued Gemini and Genesis shortly thereafter.

This development comes days after Gemini's $425 million IPO, marking a pivotal moment for the exchange amid regulatory scrutiny. The settlement, if finalized, could provide clarity for the 340,000 affected users and set a precedent for crypto lending programs.

Bitcoin Holds Steady Above $115K Amid Diverging Market Views

Bitcoin traded slightly above $115,000 in Asian hours, showing resilience after a volatile week. The modest pullback follows strong inflows into U.S. spot ETFs and persistent optimism about potential Federal Reserve rate cuts next week. Market sentiment remains divided—some see fragility in the rally, while others believe crypto is regaining momentum post-CPI jitters.

Glassnode's latest report highlights underlying weakness despite ETF inflows surging nearly 200% last week. Spot market activity appears lackluster, with shallow buying conviction, softening funding rates, and rising profit-taking—over 92% of BTC supply is currently in profit. Options traders have reduced downside hedges, narrowing volatility spreads and leaving the market exposed to sudden risk-off moves.

Contrasting this view, QCP Capital asserts cryptocurrencies are "back on track," pointing to renewed institutional interest and stabilizing derivatives metrics. The Singapore-based firm notes recovering open interest and healthier liquidity conditions across major exchanges.

NAKA Shares Collapse 54% Amid Bitcoin Treasury Fatigue

KindlyMD's NAKA shares plummeted to $1.28 on September 15, marking a 54% single-day drop and a 90% monthly decline. The healthcare-turned-Bitcoin treasury firm faces investor backlash over equity dilution plans and broader skepticism toward digital asset strategies.

The Nasdaq-listed company acquired 5,744 BTC worth $635 million this month after merging with Nakamoto in August. Its stock peaked above $15 in late August before the steep descent began. A shelf registration filing with the SEC allows gradual share issuance at market prices, exacerbating dilution fears.

Grayscale's August report highlights growing exhaustion with digital asset treasury firms, noting $755 million in outflows from Bitcoin ETPs—the first net redemptions since March. The analysis used mNAV ratios to track supply-demand imbalances.

Strategy Buys 525 Bitcoin as Capital Group’s Bitcoin Bet Hits $6 Billion

Strategy, formerly MicroStrategy, has acquired 525 BTC for $60.2 million, marking its seventh consecutive weekly purchase. The firm now holds 638,985 BTC at an average price of $73,913 per coin, yielding a 25.9% return year-to-date. Founder Michael Saylor attributes the company's outperformance against top U.S. tech stocks to its Bitcoin strategy.

Capital Group’s Bitcoin-linked investments have surged past $6 billion, led by Mark Casey. Notably, Strategy financed this purchase without selling MSTR shares, opting for alternative fundraising methods.

Strategy’s $73 Billion Bitcoin Holdings Reach Historic Milestone

Strategy, the rebranded entity formerly known as MicroStrategy, has cemented its position as the world's largest corporate Bitcoin holder with 638,985 BTC worth approximately $73 billion. The company's latest acquisition of 525 Bitcoin for $60.2 million between September 8-14 underscores its unwavering commitment to digital asset accumulation.

Since initiating its Bitcoin strategy in August 2020 under Michael Saylor's leadership, the company has transformed from a business intelligence software provider to a digital asset powerhouse. The February 2025 rebranding to Strategy reflects this fundamental shift in corporate identity and purpose.

The financial engineering behind this accumulation reveals sophisticated capital markets execution. Strategy employs multiple equity instruments - including specialized preferred shares branded as Strike, Strife, and Stride - alongside convertible debt offerings to fund its relentless Bitcoin acquisitions.

Bitcoin Trades at Discount on South Korean Exchanges Amid Volatile Premium Shifts

Bitcoin's price on South Korean exchanges diverged from global benchmarks over the weekend, trading at a 0.33% discount. The cryptocurrency was listed at $115,133 on platforms like Upbit, compared to the global average of $115,514. This marks a reversal from earlier in September, when Korean traders paid premiums exceeding 1%.

The so-called 'Kimchi Premium' has exhibited heightened volatility in recent weeks. On September 6, Bitcoin commanded a 1% premium in South Korea, only to flip to a 0.65% discount three days prior. Such rapid shifts complicate arbitrage opportunities for traders attempting to capitalize on regional price disparities.

Market observers note these fluctuations reflect dynamic liquidity conditions and localized demand patterns. The Korean Bitcoin Premium Index has shown seesawing movements throughout August and September, underscoring the challenges of maintaining price parity across global markets.

Bitcoin's Pivotal Moment Ahead of FOMC Decision

Bitcoin hovers at a critical juncture as traders await the Federal Reserve's policy signals. The cryptocurrency currently trades at $115,046.29, testing the upper boundary of its $108,000-$116,000 range. Market direction hinges on whether BTC can sustain a break above $116,000 resistance or faces retests of $107,500 support.

Short-term holders are realizing $189 million in daily profits, creating potential selling pressure. The Bitfinex Alpha report suggests Bitcoin's position at range resistance makes the FOMC outcome particularly consequential. A decisive move above $116,000 could open pathways toward $125,000, while disappointing Fed messaging may trigger liquidations.

MEXC chief analyst Shawn Young anticipates extreme volatility, noting that dovish signals could propel Bitcoin toward $120,000-$125,000 as capital rotates into risk assets. Conversely, cautious Fed commentary may spark leveraged position unwinding and tests of lower support levels.

Bitcoin Shows Strength With Potential $151,000 Breakout in Coming Weeks

Bitcoin is demonstrating renewed vigor as buyer interest surges, trading at $114,971 amid a critical technical consolidation phase. Market analysts highlight growing accumulation signals, with a potential breakout toward $151,000 looming.

The cryptocurrency's rising wedge pattern suggests short-term volatility, possibly testing support at $98K–$99K before resuming its upward trajectory. Trading volume remains robust at $49.40 billion over 24 hours, despite a marginal 0.46% dip.

Notably, on-chain data reveals unprecedented demand levels, according to analyst bitcoin Archive. This accumulation phase coincides with what ROSE Premium Signals identifies as a textbook rising wedge formation—a pattern often preceding significant price movements.

Has Bitcoin Price Topped Out as President Trump Urges ‘Too Late’ to Cut Rates?

Bitcoin's price dipped over 1% in the past 24 hours, settling near $114,665 after facing resistance at $117k. The broader crypto market followed suit, with total liquidations hitting $440 million ahead of the Fed's rate decision. Traders remain cautious as the Federal Reserve prepares to announce its benchmark interest rates this week.

Technical indicators suggest a potential mid-term reversal for BTC, with a bear flag pattern pointing toward $92k—a critical support level. The CME futures gap between $91.9k and $92.5k remains unfilled, adding to downward pressure. A decisive close above $122k, however, could reignite bullish momentum.

Market sentiment hinges on Wednesday's FOMC data. Former President Trump's comments labeling rate cuts as 'too late' inject further uncertainty. The crypto market cap now hovers at $4 trillion, reflecting a 1.2% decline during late New York trading hours.

Strategy Expands Bitcoin Holdings with $60M Purchase, Nearing 639k BTC

Strategy has fortified its position as the largest corporate holder of Bitcoin with a $60.2 million acquisition of 525 BTC. The purchase, executed between September 8 and September 14 at an average price of $114,562 per BTC, brings its total holdings to 638,985 BTC. Funding came not from operational earnings but from the sale of perpetual preferred stock, underscoring a deliberate capital markets strategy.

The company leveraged three classes of perpetual preferred stock—Series A Perpetual Strife (STRF), Strike (STRK), and Stride (STRD)—to fuel its relentless accumulation of Bitcoin. This move follows a pattern of using structured financial instruments to deepen exposure to the cryptocurrency, reflecting institutional confidence in Bitcoin's long-term value proposition.

Tom Lee Forecasts Bitcoin Rally to $200K in 2025 Amid Fed Policy Shift

Fundstrat's Tom Lee has sparked market debate with a bold prediction that Bitcoin (BTC) could surge to $200,000 by 2025. The veteran analyst cites a potential Federal Reserve policy pivot as the primary catalyst, drawing both enthusiasm and skepticism from industry observers.

Historical Q4 momentum lends credence to Lee's outlook. Bitcoin has repeatedly demonstrated explosive growth during late-year periods, particularly when macroeconomic conditions align. With institutional inflows and retail participation typically accelerating in the final quarter, traders are monitoring Fed decisions for confirmation of this bullish thesis.

"Cryptocurrencies remain hypersensitive to monetary policy," Lee emphasized during a recent CNBC interview. The Federal Reserve's nine-month pause on rate hikes has created what some analysts describe as a coiled spring for risk assets. Market participants now watch for any dovish signals that could trigger the next crypto market upswing.

How High Will BTC Price Go?

Based on current technical indicators and market fundamentals, BTC appears positioned for significant upward movement. The combination of strong institutional accumulation, positive regulatory developments, and bullish technical patterns suggests potential targets between $151,000 in the coming weeks and $200,000 by year-end 2025.

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (2-4 weeks) | $135,000 - $151,000 | Technical breakout above Bollinger upper band, FOMC decision impact |

| Medium-term (3-6 months) | $165,000 - $185,000 | Institutional adoption acceleration, regulatory clarity |

| Long-term (End of 2025) | $190,000 - $220,000 | Fed policy shifts, full-scale institutional integration |

The current consolidation above $115K, combined with massive institutional buying and positive sentiment from analysts like Tom Lee, creates a compelling case for continued appreciation. However, traders should monitor the $112K support level and FOMC decisions for near-term direction.